Last weekend, she ran in a 100 mile race. To put that in perspective, it's a race the equivalent of Dayton, Ohio to Indianapolis, Indiana ... on foot!

She had 30 hours to complete the 100 mile trek, and she was ready! She had been training for months, and she had a plan. She knew when she would rest, when to eat, when to take electrolytes and when she would ... well, when you're planning to traverse 100 petrol-free miles, you need to plan for everything!

She toed the line on Saturday morning confident, prepared and excited. Ahead of her lay six 16.6 mile laps, all she had to do was work her plan.

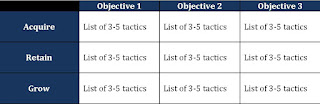

Much like the plan you're currently working. As we race into the 5th month of 2013, you fully understand your objectives, have a in-depth understanding of your target audience, know when you want to promote key products and have defined milestones to reach. You have a plan to acquire, retain and build relationships. When you toed the starting line in January, you were confident, prepared and excited too.

For about a week before the race, it had been raining in Indiana. Though the April showers might bring May flowers, they also brought terrible flooding to the ultra-marathon course. On each of the six laps, racers were expected to cross 8 knee-to-hip deep water crossings. That averages one water crossing per every 2 miles ... for 100 miles. Add to that, when the sun set, temperatures fell significantly colder than anyone had predicted. In the end, her plan was spot-on. Her legs held up great, her cardio was outstanding and her mind was clear. But after roughly 3 consecutive marathons, the water and cold won-out. With symptoms of hypothermia, she had to stop, take off her shoes, and think back on the adventure.

The real story here is not in how the race ended, but in that it ever started at all. The ambition of a 100 miler is amazing.

Now, look at your plan. What factors this year have made you want to stop, take off your wet running shoes and look back? Has unemployment taken a sharp climb in your market? Has a competitor gotten more aggressive than expected?

The lesson is that the best, most thought out planning and preparation can never prepare us for the actual outcomes. Since we will never experience life-threatening physical limitations in marketing, we simply need to adjust, tweak the plan and keep running.

We bring these marketing philosophies to credit unions and community banks nationwide, and would love to bring them to your institution too. Contact us to see how.

With nearly 211,000 visits worldwide, we hope that you enjoy this blog. If you find it helpful, please share it with your colleagues. Also, check out our YouTube Channel for short video blogs about financial marketing.

MarketMatch is also a nationally and internationally requested speaker. Contact us to bring our marketing ideas to your next conference.